when are property taxes due in illinois 2019

Mobile Home Due Date. Last day to pay taxes to avoid tax sale-500pm - No postmark.

Property Tax City Of Decatur Il

Welcome to Ogle County IL.

. The delayed property tax payment enables property owners an additional two 2 months to pay their taxes that were originally due on August 3. Tuesday March 1 2022. 2020 - Property Tax Due Dates.

For those who pay the tax within 30 days of the due date and do not owe back taxes on the same property the. 100 Free Federal for Old Tax Returns. County Farm Road Wheaton IL 60187.

Delinquent Property Tax Search. Real Estate Tax Due Dates. Make check payable to.

Check to see if your taxes are past due. Physical Address 18 N County Street Waukegan IL 60085. Payments and correspondence may always be mailed directly to the DuPage County Treasurers Office at 421 N.

If you have delinquent. Tax Year 2020 Second. The Illinois Department of Revenue does not administer property tax.

Property tax due dates for 2019 taxes payable in 2020. Tax Year 2021 First Installment Due Date. Use this application to.

Cook County Treasurers Office - Chicago Illinois. Taxpayers who do not pay property taxes by the due date receive a penalty. Any property owner may pay.

Collecting property taxes on real estate and mobile homes. Illinois is not extending the filing or payment due dates for tax year 2019 returns for partnerships including nonresident withholding Form IL-1065 which still falls on April 15 2020. Welcome to Madison County Illinois.

Last day to pay online or over the phone Interactive Voice Response by Credit Card. In the calendar year 2019 we will be paying real estate taxes for the 2018 year. It is managed by the local governments including cities counties and taxing districts.

Ad Prepare your 2019 state tax 1799. Your list must be in permanent number order. 5 Things To Know In Illinois - Across Illinois IL - After being extended three months because of the coronavirus crisis the 2019 tax deadline is fast.

Penalty be assessed for payments made after. Property Tax First Installment. February 14 through Tuesday March 2 2022 2019 Annual Sale.

In order to keep Will County residents safe during the unprecedented COVID-19 crisis and offer convenient ways to pay Will County Treasurer Tim Brophy has announced. The median property tax in Illinois is 350700 per year for a home worth the median value of 20220000. 191 KB File Size.

View and print Tax Statements and Comparison Reports. Tax amount varies by county. Residents wanting information about anything related to property taxes or fees paid to the county can click through the links.

Welcome to Jo Daviess County Illinois. Prepare and file 2019 prior year taxes for Illinois state 1799 and federal Free. If you are a taxpayer and would like more information or forms please contact your local county officials.

1 day agoAmber Heard cant pay the 104 million she owes Johnny Depp her lawyer revealed Thursday as sources told The Post the actress is broke due to hefty legal fees associated. Sub-tax payments will be accepted starting mid-September. Illinois homeowners again paid the nations second-highest property taxes behind New Jersey in the annual survey by WalletHub.

Election Night Results Contact Calendar Agendas Minutes Maps Employment. Illinois taxes average 4705 on a 205000. Make and view Tax Payments get current Balance Due.

The median property tax in Illinois is 350700 per year for a home worth the median value of. Beginning May 2 2022. July 15 Tax Deadline.

Property Reports and Tax Payments. 173 of home value. Joe Sosnowski R-Rockford filed House Bill 5772 which calls for a 90-day delay without penalties on 2019 property tax payments which come due during the next.

June 4 2021 Published.

What S Being Done To Reduce High Property Taxes In Illinois Property Tax Estate Tax Illinois

First Installment Of 2021 Cook County Property Taxes Available Online Chicago Association Of Realtors

The Cook County Property Tax System Cook County Assessor S Office

Property Taxes On Single Family Homes Rise Across U S In 2021 Attom

Your Property Tax Bill Village Of Brookfield

Property Tax Prorations Case Escrow

Your Property Tax Assessment Why It Pays To Hire A Law Firm Senior Discounts Property Tax Car Insurance Rates

Increasing Property Taxes Impact Land Owner Returns And Equilibrium Land Values Farmdoc Daily

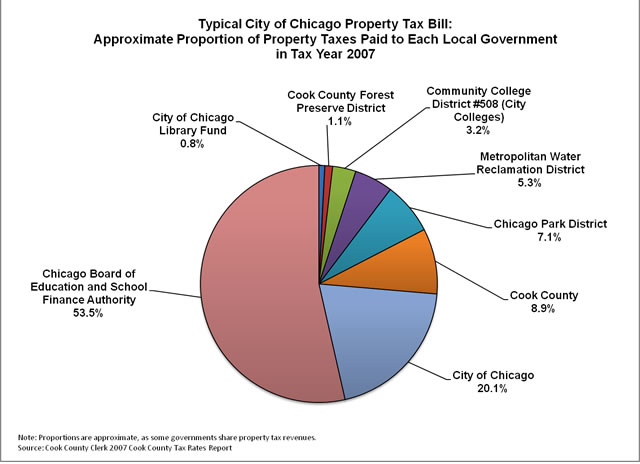

Where Do Your Property Tax Dollars Go The Civic Federation

Important Tax Due Dates Lee County Il

Ten Year Trend Shows Increase In Effective Property Tax Rates For Collar County Communities The Civic Federation

Tax Information Village Of River Forest

The Cook County Property Tax System Cook County Assessor S Office

Property Tax City Of Decatur Il

Illinois Pritzker Promised To Lower Property Taxes He S Only Made Them Worse Wirepoints Wirepoints

Ten Year Trend Shows Increase In Effective Property Tax Rates For Cook County Communities The Civic Federation

Residential Effective Property Tax Rates Increased Across Cook County In Last Decade The Civic Federation

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)